By Thomas Plank – CEO Tributech

In today’s data-driven world, data lineage and integrity have become crucial for all industries, especially for the finance industry. Financial institutions generate and process massive amounts of data daily, and the integrity of this data is vital for informed decision-making, regulatory compliance, risk management, and maintaining public trust. However, achieving data lineage and integrity is not without its challenges, and data integration is one of the most significant obstacles that financial institutions face. In this blog post, we’ll explore the significance of data lineage and integrity for the finance industry as well as how they intersect with the data integration challenges.

In the finance industry, regulatory requirements are constantly evolving, and ensuring data integrity and data lineage can help institutions comply with regulations by providing a clear audit trail of the data used in their processes. For example, data lineage can help institutions show how they arrived at certain financial calculations, such as risk assessments or financial reporting, and demonstrate that they are in compliance with regulations such as NIS2, DORA, Sarbanes-Oxley Act, and the Basel III accord.

WHAT IS DATA LINEAGE?

Data lineage refers to the ability to trace data from its source through its processing and transformations to its destination. It helps in identifying the origins of data, understanding the data’s flow, and ensuring the data’s accuracy, consistency, and completeness. Data lineage is critical in the finance industry, where the data is used to calculate financial statements, identify risks, and make investment decisions. Understanding the source of data and how it was processed is essential to ensuring the accuracy of financial statements, complying with regulatory requirements, and detecting and preventing fraud.

Data lineage can help institutions quickly identify the sources of errors or discrepancies in their data, so they can take action to correct them before they become bigger problems.

WHAT IS DATA INTEGRITY?

Data integrity, on the other hand, refers to the accuracy, completeness, and consistency of data over its entire lifecycle. Maintaining data integrity is critical in the finance industry, where decisions are made based on data. Errors or inconsistencies in data can lead to incorrect financial statements, wrong investment decisions, and regulatory non-compliance. It also leads to incorrect risk assessments, resulting in financial institutions taking on more risk than they can handle. In addition to the financial risks, tampered data can also result in legal and repetitional risks. Financial institutions that are found to have tampered with data can face legal sanctions, fines, and damage to their reputation, which can affect their ability to do business.

WHAT ARE THE CHALLENGES IN DATA INTEGRATION?

Data integration refers to the process of combining data from different sources, formats, and systems to create a unified view of data. In the finance industry, data integration is essential, as financial institutions must aggregate data from various systems and sources to support critical business processes, such as risk management, compliance, and financial reporting.

However, data integration is not a simple task, and financial institutions face several challenges that can make it difficult to achieve data lineage and integrity. Financial institutions use various systems and platforms to manage their data, and these systems may store data in different formats, making it difficult to combine and integrate data. Moreover, data from external sources, such as market data providers or credit rating agencies, may come in different formats and structures, making it challenging to integrate with internal data systems.

Data integration also raises concerns around data security and privacy. Financial institutions must ensure that data is secured and protected when integrating data from different sources.

Despite these challenges, financial institutions must prioritise data integration to achieve data lineage and integrity. This requires implementing robust data management practices and tools, such as data governance, quality management, data lineage tools, and robust data integrity protection to trace data back to its source and ensure that data is accurate and reliable.

Data Governance: Implementing a robust data governance program is essential for ensuring data lineage and integrity. It involves defining policies, procedures, and standards for data management, monitoring compliance, and enforcing regulations. A data governance program provides a framework for managing data across the entire organisation, ensuring that data is accurate, consistent, and reliable.

Data Quality Management: A comprehensive data quality management program can help ensure data integrity. It involves defining data quality metrics, measuring data quality, identifying data quality issues, and taking corrective actions. Data quality management ensures that data is accurate, complete, and consistent, reducing the risk of errors and inconsistencies.

Data Lineage Tools: Using data lineage tools can help trace the data’s journey from its source to its destination. These tools provide visibility into the data’s flow, transformations, and processing, enabling organisations to identify issues and ensure data accuracy.

Data Integrity Protection: Detect data tampering is essential for maintaining data integrity. It involves implementing strict access controls, data encryption, and data backups. Regular data backups and disaster recovery plans can help ensure that data is not lost due to system failures, natural disasters, or cyber-attacks.

HOW TRIBUTECH ADDS VALUE TO ESTABLISH DATA LINEAGE & INTEGRITY

Collecting, transmitting, verifying and utilising your data can be an incredibly complex process. Whether it is transferring data across different systems, integrating data from various sources or trusting it after a system failure or cyberattack, understanding the issue and implementing the necessary protection can seem overwhelming.

Encrypting data end-to-end helps ensure that data is unaltered when in transit or at rest. However, it has limited capabilities during transfers, with time delay and often covers only parts of the data pipeline. Additionally, data gets decrypted for utilisation and afterwards encrypted again – with this the link to the origin is broken and data integrity can’t be guaranteed any more.

Tributech’s blockchain technology ensures that you can check the data integrity right through its lifespan, regardless of how many times it has been encrypted/decrypted and how many hands it has been passed through.

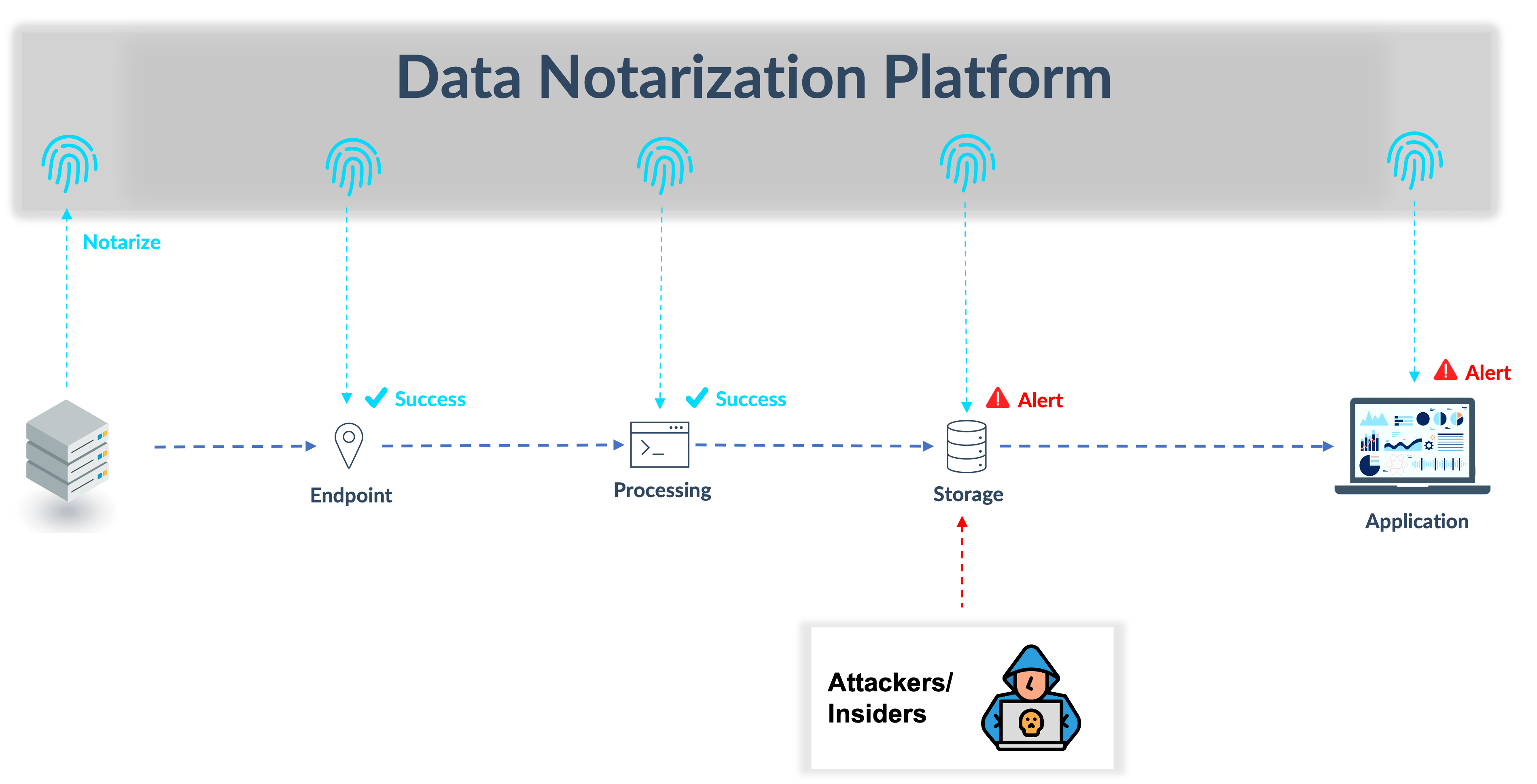

Our Data Notary functionality helps you to keep deliberate misinformation away from your data platform or data service by acting as an independent party at the data source that verifies origin and integrity of the data.

One part of the data notary service is located directly at the data source and creates cryptographic proofs of the data, which are securely stored in a blockchain-based trust layer. The second part of the data notary service is integrated in the backend and enables the consumer of the data to verify origin and integrity across systems and companies at any time – even of high-frequency data streams.

Our data integration and security platform give you end-to-end visibility, rapid identification, traceability, performance and auditability of all your data streams. It allows you to trust your data and utilise it with confidence and without compromising security.

This means that critical decision making can be made with confidence. Go beyond encryption and add a new level of security to detect data tampering within your organisation.